Client Profile

Client runs a medium size import company.

- Business is owned by himself and has several brothers and most key positions.

- Business would continue upon the death of any of the family members.

- Current total net worth $10 Million+.

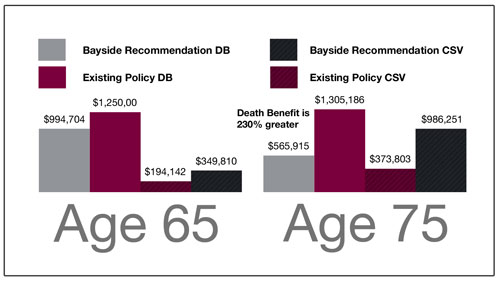

Comparison of Future Values

The Bayside Report showed that they were substantially better options available in today’s marketplace.

The Client had so many small policies that they were paying over two thousand dollars per year just in policy fees.

The Client found out that they would have had to cancel their policies to access the cash values that were building up in their existing policies.

Business insurance coverage had not been coordinated with the personal coverage.

Business owner was substantially under insured for current situation, little to no contact with agent.

Bayside Associates Recommendation

Increased Company owned coverage to levels that will now adequately payout; lines of credit, mortgages and other liabilities. Also it now protects the Company cash-flow at the death of any of the key personnel.

Setup Corporate Universal Life Program with coverage on each sibling.

- This allows for adequate protection to operating company.

- Tax sheltering of business profits.

- Funds to be accessed later to help fund retirement (if needed).

- Death Benefit proceeds to be used to pay growing tax liability.

- Cash value to be used as collateral on a tax deductible loan that will be used to invest in a secondary company that furnishes second mortgages.

|